|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy Chapter 13 in Texas: What You Need to Know

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a legal process that allows individuals in Texas to reorganize their debts while keeping their assets. Unlike Chapter 7, which involves liquidating assets, Chapter 13 offers a structured repayment plan.

Key Features of Chapter 13

- Repayment Plan: Debtors propose a repayment plan that lasts three to five years.

- Debt Limits: There are limits on the amount of secured and unsecured debts.

- Income Requirements: Debtors must have a regular income to qualify.

It's crucial to understand these features to navigate the process effectively.

Steps to File for Chapter 13 Bankruptcy

Filing for Chapter 13 in Texas involves several steps:

- Credit Counseling: Complete a government-approved credit counseling course.

- File Petition: Submit a bankruptcy petition with the Texas bankruptcy court.

- Propose a Plan: Develop and propose a repayment plan that meets the requirements.

- Court Confirmation: Attend a confirmation hearing where the court approves your plan.

Each step requires careful attention to detail, often necessitating professional guidance. For more insights on how to avoid filing bankruptcy, explore other financial strategies available.

Benefits and Drawbacks of Chapter 13

Benefits

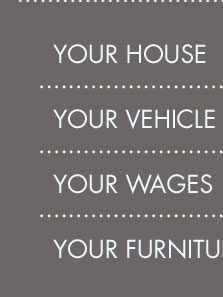

- Asset Protection: Keep your home and car while repaying debts.

- Debt Discharge: Certain debts may be discharged after plan completion.

Drawbacks

- Long Process: The repayment plan requires a long-term commitment.

- Impact on Credit: Bankruptcy affects your credit score for years.

Understanding these pros and cons helps in making an informed decision.

Frequently Asked Questions

What happens to my property in Chapter 13 bankruptcy?

In Chapter 13 bankruptcy, you can keep your property, including your home and car, as long as you adhere to the repayment plan.

How does Chapter 13 affect my credit score?

Filing for Chapter 13 bankruptcy will impact your credit score negatively, typically remaining on your credit report for up to seven years.

Can I convert my Chapter 13 to Chapter 7?

Yes, you can convert your Chapter 13 bankruptcy to Chapter 7 if you meet the eligibility requirements for Chapter 7.

Getting Professional Help

Given the complexities involved in filing for bankruptcy, consulting a bankruptcy attorney in Arlington, TX, or your local area can provide the expertise and guidance needed to navigate the process successfully. Professional advice ensures your interests are well-protected.

Chapter 13 Is Designed for Individuals - Have Enough Income to Make Monthly Payments - Have a Debt Profile Within the Accepted Limitations - You ...

State employees who declare bankruptcy under Chapter 13 must file a debt adjustment plan with the bankruptcy court. The plan must detail when and how the ...

You can use Chapter 13 to prevent a house foreclosure; make up missed car or mortgage payments; pay back taxes; stop interest from accruing on your tax debt ( ...

![]()